Background

The EU FDI Screening Regulation (the Regulation) creates a framework for greater coordination in screening FDI in the EU on security and public order grounds, without establishing a mandatory screening mechanism at EU level. By contrast, member states remain solely responsible for protecting their essential security interests and adopting their own FDI vetting procedure. Unlike in merger control, the Regulation does not give the EU powers to intervene in M&A transactions and leaves the last word to EU Member States. As we previously reported, the Regulation sets out common requirements that national mechanisms must comply with and establishes a cooperation mechanism among member states, and between member states and the European Commission.

The European Commission’s first annual report

The First Annual Report on FDI screening ("Report") draws from information provided by the 27 Member States1 and has been released along the Annual Report on Dual Use Export Controls on 23 November 2021. The European Commission ("Commission") sees both matters as closely related and also published a combined illustrated brochure on the reports.

Among a host of interesting information on FDI in the EU, the Report presents the following key findings:

- In 2020, 7 Member States reviewed 1,793 investment dossiers, out of which only 20% of them, i.e., 359, underwent formal screening. Further, out of the 359 screened transactions, only 2% were blocked and 12% authorized with conditions.

- From 11 October 2020 through 30 June 2021, 265 transactions where submitted by 11 Member States under the cooperation mechanism. 90% of those transactions were notified by five Member States alone: Austria, France, Germany, Italy and Spain.

-

- 80% of these transactions did not justify further investigation and were thus assessed by the Commission in just 15 days (the so-called Phase 1), while 14% proceeded to Phase 2, which requires a more detailed assessment.

- Most of the 265 notified cases concerned the manufacturing sector, ICT, wholesale and retail.

- The top five countries of origin of investors were companies located in the United States (45%), the United Kingdom (9%), China (8%), Canada (4%) and the United Arab Emirates (3%).

- The Commission issued an opinion in less than 3% out of 265 screened cases. For background, Commission opinions are issued only where the investor’s risk profile and the criticality of the investment warrant so.

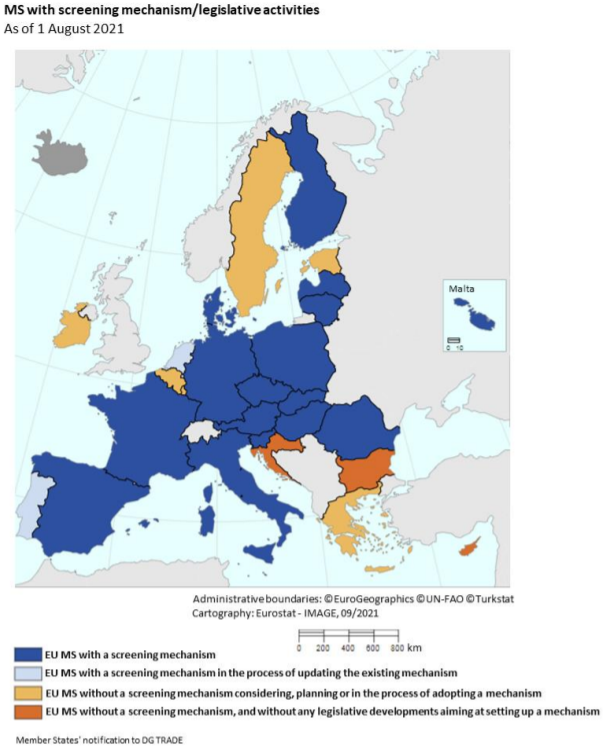

The Commission now counts 18 FDI screening mechanisms among the 27 Member States and expresses the view that “[t]he FDI screening cooperation mechanism works effectively and does not create unnecessary delays for transactions”. This view is interesting, since still one third of Member States do not have screening mechanisms in place and many Member States encounter significant procedural issues. Several Member States indicated that "too many transactions are notified under the Regulation, including FDI transactions with no relevance for, or impact on, other EU Member States." The very low number of screened cases with issued Commission opinions in combination with the high number of transactions closed in Phase 1 raise questions as to whether the Commission has cast its net for screening too wide. Certain Member States proposed that the Commission develops guidelines about which cases must be notified.

With regard to multi-jurisdictional transactions that require notification in various Member States, the Commission acknowledges the challenges to navigate the timelines and requirements of the various Member States' regimes. The Commission seems ready to consider further how to improve the handling of such cases, which represent around one third of the total notifications.

Member States tend to stop the clock on their FDI procedures during the cooperation procedure with the Commission. This means, in turn, that in 80% of the reviewed transactions the parties may have had to wait up to 15 days longer until clearance was completed, despite there being no issues.

A map provided by the Commission shows that one third of Member States still do not have or are only in the process of setting up an FDI regime. This is in line with developments on tightening FDI rules and their enforcement in the rest of Europe as well as globally. The UK has set up its own mandatory FDI regime, which will take effect on 4 January 2022. Recently regulators have become more and more active in imposing conditions on deals or prohibiting them altogether under FDI rules – with prohibitions happening in the EU’s largest economies Germany, France and Italy.

Source: European Commission

Read our previous blogs on related topics here:

References

1 Under Article 5 of the Regulation, Member State must submit to the European Commission an annual report containing aggregated information on FDI in their territory.

Authored by Falk Schöning, Lourdes Catrain, Stefan Kirwitzke, and Eleni Theodoropoulou.