As investors prepare for M&A transactions, turning a blind eye to FDI screening regimes risks missing a mandatory filing requirement, which could result in fines, legally void transactions and even constitute criminal offenses. Hogan Lovells has a global FDI team consisting of experts in national security, trade law, regulatory procedures and corporate M&A that helps clients navigate the uncertainties that FDI questions can pose for global transactions. Working at the intersection of business and government, Hogan Lovells is uniquely placed to advise clients on transactions that may fall under one or more FDI screening regimes around the world.

Jurisdictions have very different FDI regimes, partly due to the different stages of development of their economies, and the objectives pursued by their governments. The diversity of cultural backgrounds also plays a role in shaping their FDI regimes. For example:

- Developing economies typically seek to channel FDI where it is most needed according to their own development objectives, and to encourage investments that allow for the sharing of know-how and the development of domestic capabilities through joint ventures between foreign investors and local players. Therefore, the use of "negative lists" or "positive lists" in China, India, Indonesia and Vietnam is a concept that is largely unheard of in more developed economies that do not have any general restrictions on FDI.

- While Asian jurisdictions, such as China, India, Indonesia, Mongolia and Vietnam, have relaxed FDI scrutiny in recent years to attract more FDI, most of the Western jurisdictions are bringing even more industry sectors under the FDI scrutiny spotlight and are significantly increasing FDI enforcement. In 2022 alone, a number of high-profile deals were blocked or unwound by FDI regulators in major Western economies, including in Germany, Italy and the United Kingdom.

- Each jurisdiction has its own FDI procedure, which varies widely. Some are very complex, involving multiple authorities and may involve several time-consuming phases of review. Others are at the other end of the spectrum and do not scrutinize FDI outside of specific industry sectors. There are also major differences in the way FDI regimes deal with the acquisition of non-controlling minority shareholdings, stake building, greenfield investments, and internal restructuring.

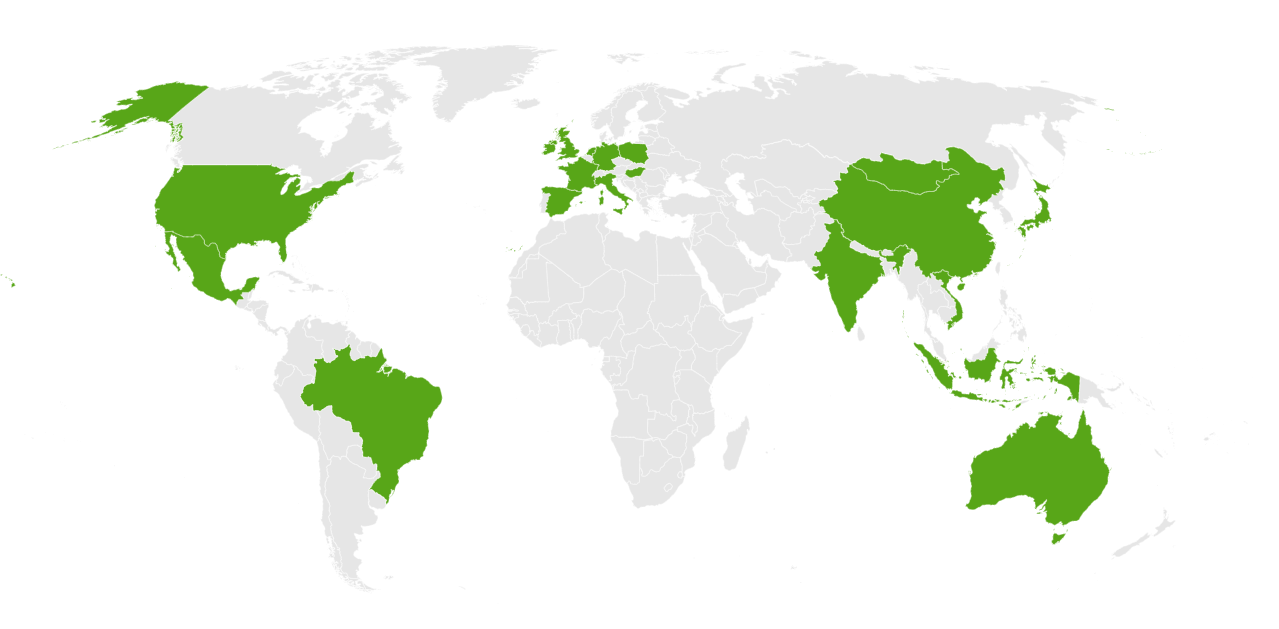

Our Global Legal Guide provides insight into and comparison of FDI screening regimes in 20+ key jurisdictions in the Americas (Brazil, Mexico, USA), Asia-Pacific (Australia, China, Hong Kong, India*, Indonesia, Japan, Mongolia, Singapore and Vietnam), and EMEA (France, Germany, Hungary, Ireland, Italy, Luxembourg, the Netherlands, Poland, Spain and the United Kingdom) where Hogan Lovells has offices. A summary of key features (e.g., types of transactions subject to mandatory or voluntary filing, principal authorities, look-back period, test for intervention, extraterritorial reach, timeline for review and potential penalties) plus a detailed Q&A provide a roadmap for navigating the FDI regimes in these jurisdictions.

Due to the complexity and intricacies in the regulations, understanding the FDI regimes is crucial for cross-border investors. Identifying the applicable laws and carefully assessing the potential concerns at an upfront stage can minimize the risks and is essential to the strategic planning of any transaction. Given the rapidly evolving legal landscape, our experts of the global Hogan Lovells FDI team can assist investors with in-depth knowledge and comprehensive strategies to address FDI issues.

Please refer to the Contacts page for a list of our experienced contributors able to assist.

* Content provided by our India focus group based in our Singapore office.